EC ‘23 Tutorial: Partial Mechanism Design and Incomplete-Information Industrial Organization

Equilibrium effects play an important role in mechanism design applications. These effects arise when a mechanism designer does not control the entire market, and as such we refer to this as a problem of partial mechanism design. For example, the design of public housing policy must account for its equilibrium impact on the private housing market. After all, the set of consumers who apply for public housing depends on the prices of private apartments, while the set of consumers who participate in the private market (and hence the prices in the private market) depends on the mechanism for allocating public housing. Equilibrium effects can substantially influence the optimal structure of mechanisms.

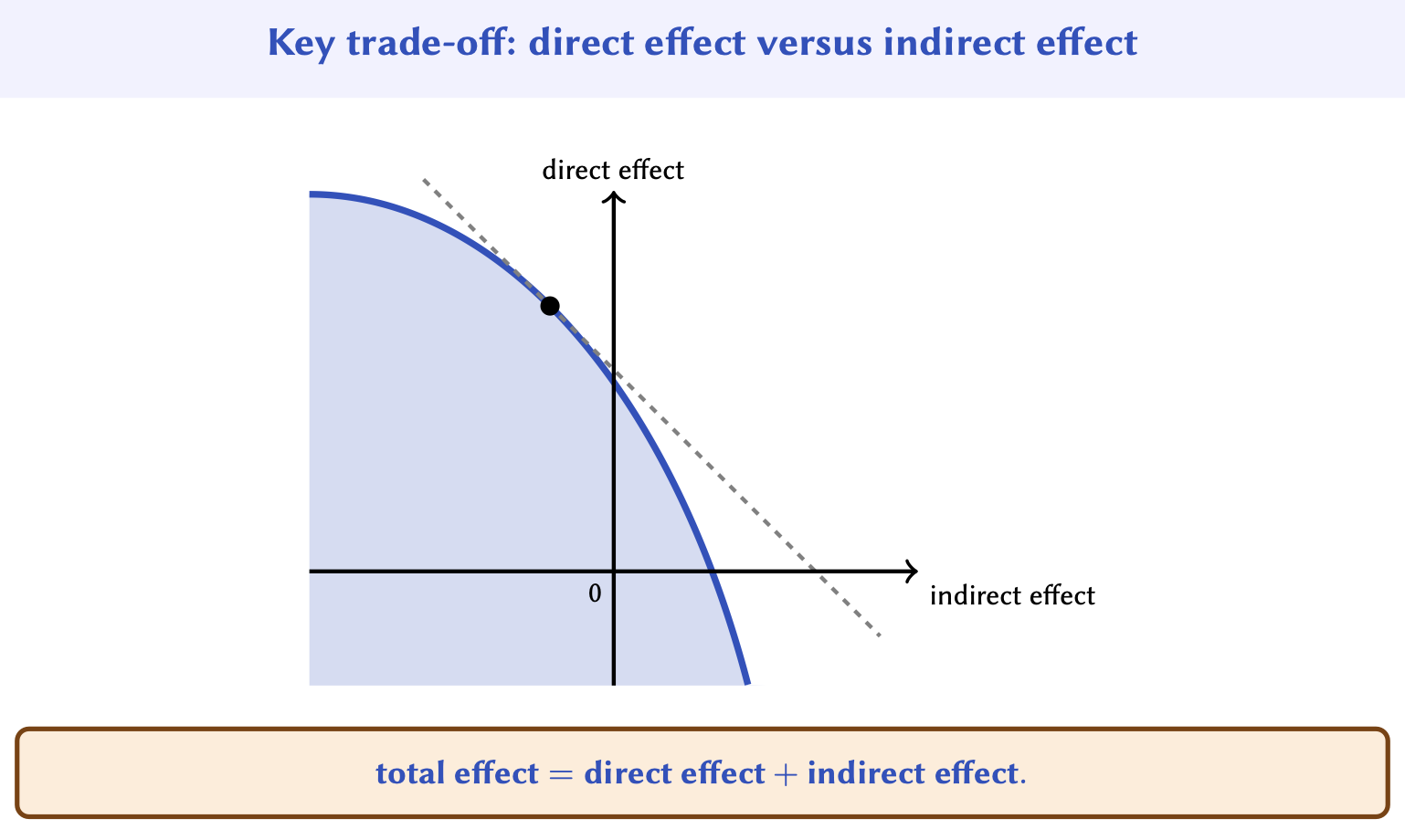

In this tutorial, we show how classic tools from mechanism design can be adapted to study the equilibrium effects in partial mechanism design problems and derive the corresponding optimal mechanisms. We show how these problems can be analyzed by studying the trade-off between the direct effect and the indirect effect of these policies: the direct effect of the mechanism captures the impact on individuals who are allocated the good, while the indirect effect captures the equilibrium impact of the mechanism on individuals who are not allocated the good. We present a unified framework of recent advances, with applications ranging from resale markets and vertical contracting by dominant firms to redistributive policies in private markets.

More generally, our framework coheres with the incomplete-information industrial organization (or “Triple-IO”) research agenda. (See Loertscher and Marx, 2021 for an excellent overview of recent developments.) Incomplete-information models provide a natural and powerful approach for studying problems in industrial organization, where equilibrium effects and private information held by market participants both play an important role in shaping outcomes. Unlike standard complete-information or mechanism design models, our framework places no restrictions on contracts that firms may select and does not assume that firms control the entire market.

Target Audience

This tutorial is targeted at researchers, graduate students, and advanced undergraduate students in economics and/or computer science.

Prerequisites

We will assume basic familiarity with mechanism design.

Structure

This tutorial consists of two 45-minute sessions:

- Part I (Ellen)

- Introduction and motivation

- General framework to study equilibrium effects of contracts

- Application #1: profit maximization with resale

- Part II (Zi Yang)

- Application #2: redistributive policies in a private market

- Application #3: vertical contracting

- Conclusion and open questions

Materials

Slides are available here.

References

We will endeavor to keep the list below updated (even after EC ‘23). Please contact us with any suggestions to add to this growing list!

Key Papers

- Kang, Z. Y. (2023): “The Public Option and Optimal Redistribution,” Working paper.

- Kang, Z. Y. and E. V. Muir (2022): “Contracting and Vertical Control by a Dominant Platform,” Working paper.

- Loertscher, S. and E. V. Muir (2022): “Monopoly Pricing, Optimal Rationing, and Resale,” Journal of Political Economy, 130, 566–635.

Related Papers

- Dworczak, P. (2020): “Mechanism Design With Aftermarkets: Cutoff Mechanisms,” Econometrica, 88, 2629–2661.

- Fuchs, W. and A. Skrzypacz (2015): “Government Interventions in a Dynamic Market With Adverse Selection,” Journal of Economic Theory, 158, 371–406.

- Loertscher, S. and L. M. Marx (2021): “Incomplete-Information Models for Industrial Organization,” Working paper.

- Philippon, T. and V. Skreta (2012): “Optimal Interventions in Markets With Adverse Selection,” American Economic Review, 102, 1–28.

- Tirole, J. (2012): “Overcoming Adverse Selection: How Public Intervention Can Restore Market Functioning,” American Economic Review, 102, 29–59.